Laura Gerhard

Vice President

OVERVIEW

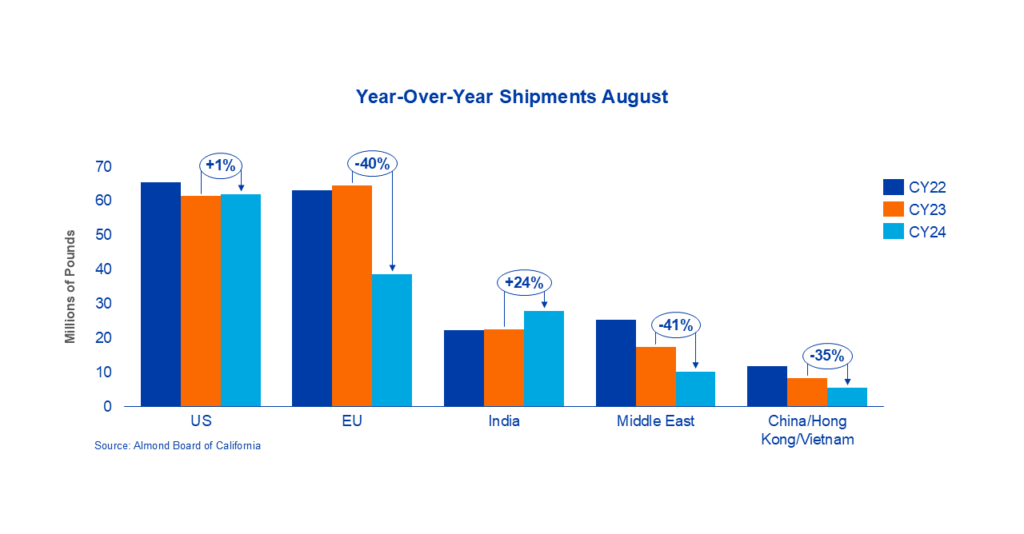

The California almond industry begins the 2024 crop year with August shipments totaling 168.3 million pounds, a decrease of 6% from the previous month and 21% from last year. Domestic shipments were strong at 62.1 million pounds, up 1% from the previous year. In contrast, exports cooled to 106.2 million pounds, down 29% from the prior year. Overall, shipments fell short of expectations due to slower exports resulting from tight inventories at the end of the 2023 crop year. However, with new crop inventories now available, September shipments are anticipated to increase.

SHIPMENTS

India: India begins the crop year on a high note with shipments totaling 27.9 million pounds, marking a 24% increase from the previous year. After a sluggish July, market activity picked up throughout the month due to dwindling local inventories and longer transit times. As a result, prices strengthened. Demand is expected to remain robust through October and into November as the market prepares to meet post-Diwali needs.

China/Hong Kong/Vietnam: Shipments to the region totaled 5.5 million pounds, marking a 35% decline from last year. Chinese buyers have increasingly favored Vietnam due to its duty advantage, with Vietnam receiving 3.8 million pounds of this volume, a 71% increase

from the previous year. Buyers have returned to the market, gaining confidence that prices are unlikely to drop in the near term. The Mid-Autumn Festival, celebrated this week (September 15-17), will be closely monitored for insights into consumer demand. This holiday, a precursor to Chinese New Year, will significantly influence buying activity in the weeks leading up to the festival.

Europe: Shipments to the region reached 38.7 million pounds, a 40% decrease from last year. In Europe, buying activity has slowed, resulting in a more cautious market. Buyers are currently making minimal purchases, hoping for signs that prices might soften before placing larger orders. This hesitation is preventing significant buying beyond immediate needs. As prices remain stable without signs of decline, buying activity is anticipated to increase as the region gears up for upcoming holiday demand

Middle East: Shipments to the region totaled a modest 10.2 million pounds, marking a 41% decline from last year. This drop was anticipated due to limited buyer activity as they awaited softer prices to conclude the previous crop year. As local supplies have diminished, activity has increased recently, with buyers requesting prompt shipments. Demand is expected to remain strong in the coming weeks, driven by the early timing of Ramadan in 2025 and the need for buyers to secure coverage well in advance due to lengthening transit times.

Domestic: In August, shipments totaled 62 million pounds, a modest 1% increase from the previous year. After a volatile year for monthly shipments, it’s promising to see the domestic market begin positively despite limited inventories of in-demand products. New sales for the month were 9.1 million pounds, with total commitments down 26.8% compared to last year. On a positive note, recent weeks have shown a rise in sales as buyers adjust to post-Objective Estimate pricing. With substantial demand still to be met for the current crop year, buyer activity is expected to continue.

COMMITMENTS

Total commitments for the year start at 607.6 million pounds, a 2% decrease from last year. However, uncommitted inventories have dropped significantly to 11.1 million pounds, down 68% from the previous year. New sales have also fallen sharply by 62% to 159.3 million pounds, as buyers delay purchases in anticipation of lower prices. With an expected crop of 2.8 billion pounds, current shipments and commitments account for 24% of the total supply, compared to 26% last year. Although industry commitments are down by 2%, destination inventories are lighter than last season. Given the recent increase in demand for prompt shipments, the industry is anticipated to close this gap and make up for lost ground.

The carry-in figure was the most notable surprise of this position report. The carry-out from July’s position report was adjusted with an actual loss and exempt percentage of 2.1%. This put the carry-in at 503 million pounds which is significantly higher than the industry was expecting due to the lower 2023 crop quality that had an average of 4.2% of rejects.

CROP

Crop receipts for the year begin at 290.1 million pounds, reflecting a 314% increase compared to the previous crop year, which experienced a delayed harvest by 2-3 weeks. Recent concerns have emerged regarding lower yields from the southern region of the valley, leading many in the industry to doubt the feasibility of a 3.0-billion-pound crop. Some are even speculating that the final yield could fall below 2.8 billion pounds. Consequently, California packers are adopting a cautious stance, limiting offers until there is greater clarity on the new crop’s potential

|

Market Perspective The 2024 crop year begins with mixed results. Shipments fell short of expectations due to softer demand at the end of the 2023 crop year. Buyers approached the new season with caution, anticipating potential price pressure as harvest commenced. Unlike last year, when the industry faced significant carry-in pressure, this year does not have the same burden. Despite the subdued demand, prices have remained stable with no signs of decline. As buyers begin to cover upcoming demand and replenish inventory, prices are expected to stay supported, particularly as regions prepare for the holiday season. As the harvest progresses, the industry will continue to assess crop quality and supply potential. The total supply outlook will remain uncertain until more clarity is gained on the carry-in figures. Come visit us at SIAL Paris in Hall 8 D 159. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here