Laura Gerhard

Vice President

OVERVIEW

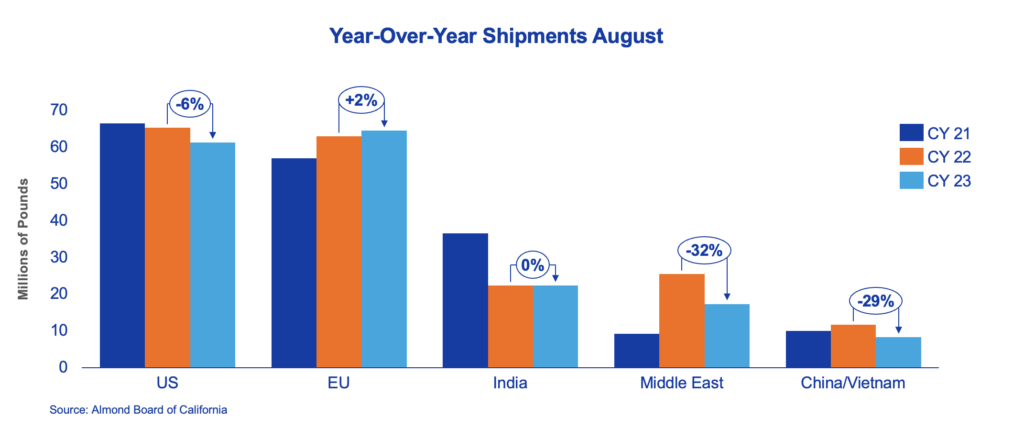

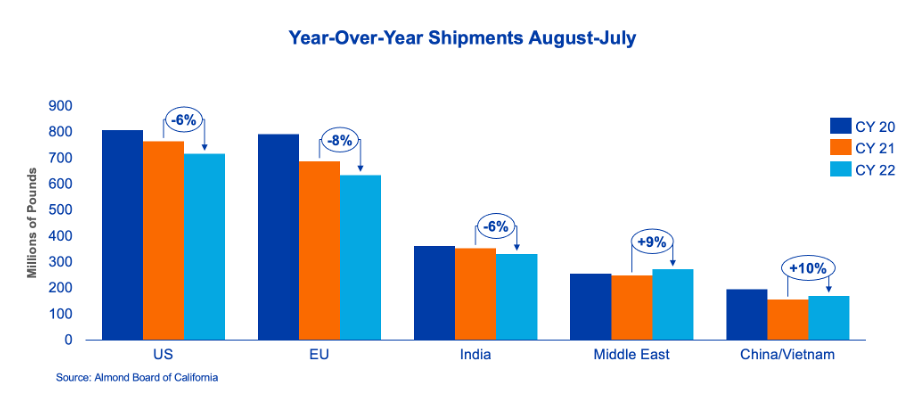

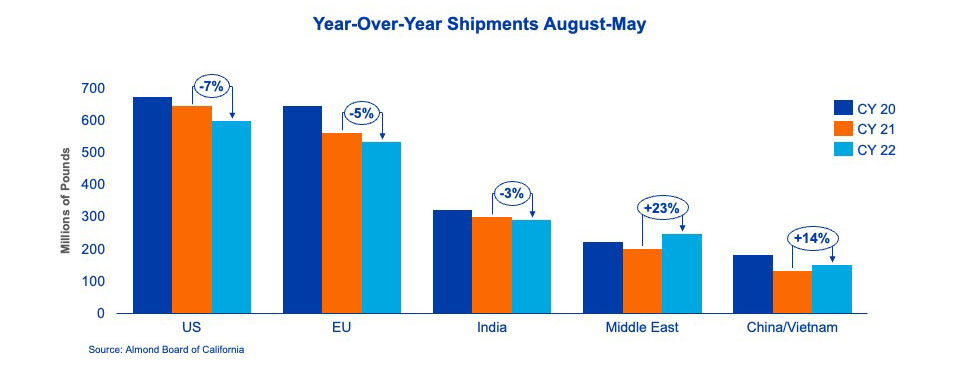

Shipments for August exceeded industry expectations at 212 million pounds. This was up 13.6% to last month and 7.1% off last year’s record shipment. This was the industry’s second largest shipment number for the month of August in history. Domestic shipments were 61.4 million pounds, up 8.6% to last month but down 6.2% to last year. Export shipments were 150.1 million pounds, up 15.7% to last month and 7.5% off compared to last year. Given the slow start to the 2023 harvest, the August shipment number primarily represented crop year 2022 sales as very limited 2023 crop volume was available for shipment.

SHIPMENTS

India: Shipments to India remained flat for the month at 22.5 million pounds, mainly reflecting the 2022 crop availability due to a delayed start to the 2023 harvest. The Indian market was active in early August to compensate for lighter summer shipments. With many August shipments postponed to September due to the delayed harvest, we anticipate strong September shipments. California’s quality concerns with initial crop receipts led to slower new sales and firmer prices in recent weeks.

China/Hong Kong/Vietnam: Shipments to the region were 8.5 million pounds for the month which is down 24.5% to last year. A slow start was expected given the delayed California almond harvest as well as sufficient inventories in China to cover demand for the upcoming Mid-Autumn festival. Demand is expected to pick up in the coming weeks with buyers needing to get supplies moving to ensure on-time arrival for Chinese New Year.

Europe: The European markets saw an increase in shipments for August, up 2% to last year, and a new record for the month of August. The European market has seen relatively stable 2022 and 2023 crop standard prices and continue to buy hand-to-mouth. Most European buyers are looking for purchases in Q1 of 2024, with much of their short-term demand already covered. The European market, much like the US market, continues to struggle with weaker consumer demand and higher than necessary almond prices at retail.

Middle East: The Middle East markets saw a 32% drop in shipments versus a year ago. Even with that decline, the Middle East saw their 2nd strongest August shipments in history with last year being such a strong outlier. As the market begins to move out of the warmer summer months with local supplies more in balance, look for demand to return to the region in the coming months.

Domestic: August shipments for the domestic market were off 6.2 % from prior year, and the lowest August figure since crop year 2016. Inflation impacts on food pricing has dampened consumer buying within the retail segment as consumers focus on staples and frequency type items. As supply chains and inflation outlook are beginning to stabilize, the US Market has ample opportunity to ramp up shipments in the coming months. Domestic commitments for crop year 2023 lag prior year by 17%, with many customers still buying for the short term, and continuing to work through long contracts.

COMMITMENTS

Total commitments were 621.9 million pounds, up 1.3% to last year. Uncommitted inventory starts the year at 35 million pounds, down 86.1% to last year and primarily a result of low receipts. New sales for the month were 256 million pounds, which is 31% higher than last year and reflective of strong activity for the month. A good portion of this was comprised of export sales.

The 2% Loss and Exempt was revised down from last position report pushing the carryout volume to just over 800 million pounds. California starts the crop year at 24.9% sold and shipped against total supply, flat to last season.

CROP

August crop receipts were just over 70 million pounds, 73.5% less than the same time last year. This is reflective of the later harvest timing, which is approximately 3 weeks behind last season. Harvest has since picked up throughout much of the valley.

Many in the industry are concerned about the quality of the 2023 crop. Rainfall hit the Southern growing region of the valley just as harvest got underway, causing concern for mold and shell stain. Insect damage is prevalent across the entire valley resulting from the wet weather experienced last winter which prevented growers from getting out into the orchard to perform sanitation procedures. These quality issues have the potential of reducing the supply of higher quality inshell and kernels. The initial deliveries of almonds tend to be lower quality. With a small portion of the crop delivered to date, it is yet to be seen if these quality issues will persist or improve over time. With the 2023 crop forecasted at 2.6 billion pounds, the total supply for the upcoming season is essentially unchanged compared to last year. Harvest is finally underway and is approximately two weeks later than last year.

|

Market Perspective The August position report begins the 2023 season on a positive note with shipments larger than many expected. Many markets were active over the last month as attractive price levels persisted up to harvest. Price has since firmed over quality concerns of the initial deliveries of the 2023 crop causing packers to take a more conservative approach until more of the crop is received and reviewed. The focus of the industry going forward will be on monitoring the ongoing harvest with a particular eye on quality. The outlook for the 2023 crop will become clearer over the coming weeks as receipts are evaluated for quality, size, and supply potential. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here